BTC Price Prediction: Analyzing the Path to $125K Amid Bullish Technical and Fundamental Signals

#BTC

- Technical Momentum: Bullish MACD divergence and Bollinger Band support suggest upward price potential

- Institutional Demand: Businesses accumulating BTC at 4x mining rate indicates strong fundamental support

- Political Catalysts: Trump's crypto embrace and new Bitcoin listings provide additional bullish momentum

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Divergence Signals

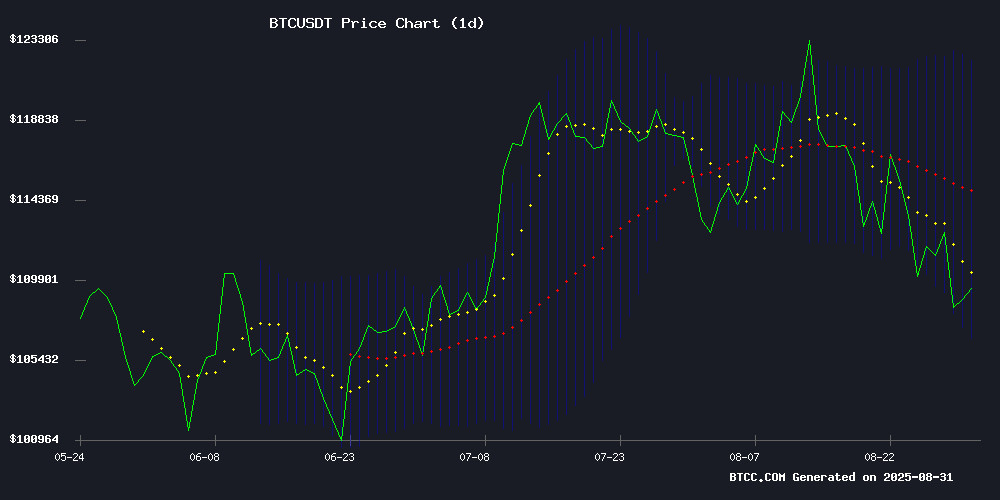

BTC is currently trading at $108,432, below its 20-day moving average of $114,347, indicating short-term bearish pressure. However, the MACD reading of 4,385.65 above the signal line at 2,782.66 suggests building bullish momentum. The Bollinger Bands show price NEAR the lower band at $106,433, which often acts as support. According to BTCC financial analyst Sophia, 'The MACD divergence combined with support near the lower Bollinger Band creates a potential reversal setup targeting the upper band around $122,260.'

Market Sentiment: Institutional Accumulation and Political Catalysts Support Bullish Outlook

Multiple positive catalysts are emerging for Bitcoin. Businesses are accumulating BTC at four times the mining rate, indicating strong institutional demand. The launch of 'American Bitcoin' on Nasdaq and Trump's pro-crypto stance provide additional tailwinds. BTCC financial analyst Sophia notes, 'The combination of institutional accumulation, regulatory clarity, and high-profile listings creates a fundamentally supportive environment for price appreciation toward $125,000 targets.'

Factors Influencing BTC's Price

Gold vs. Bitcoin: Divergent Roles in Portfolio Hedging Amid Trump’s Crypto Embrace

Investors are reevaluating gold’s supremacy as a hedge asset following the Trump administration’s pro-crypto stance. Historical data reveals gold’s resilience during equity sell-offs, gaining 5% in 2022 while the S&P 500 plunged 20%. Its near-zero correlation with stocks cements its status as a traditional safe haven.

Bitcoin, however, tells a different story. The cryptocurrency cratered 60% alongside tech stocks in 2022 but has shown an inverse relationship with bond markets. As Treasury yields surged in 2023 on fiscal concerns, BTC’s negative correlation with government debt emerged as a potential counterbalance—a trait gold lacks.

El Salvador Diversifies Bitcoin Reserves Across Multiple Addresses for Enhanced Security

El Salvador has strategically redistributed its 6,300 BTC holdings across 14 separate addresses, abandoning its previous single-address storage model. The move, executed by the National Bitcoin Office, aims to mitigate risks posed by potential quantum computing threats while adhering to Bitcoin management best practices.

The restructured reserves now hold no more than 500 BTC per address, with the total cache valued at approximately $682 million at current prices. Officials emphasize this fragmentation reduces vulnerability to cryptographic attacks, particularly those leveraging exposed public keys in unused addresses.

Blockchain data confirms the Friday transfer, which positions El Salvador as a pioneer in sovereign Bitcoin risk management. The strategy specifically addresses theoretical concerns about quantum computers compromising the ECDSA signing algorithm, though such capabilities remain speculative in current technological landscapes.

Bitcoin Eyes $125K as Analysts Debate Divergence Signals; Remittix Gains Traction

Bitcoin's recovery to $112,000 has reignited bullish momentum, with analysts targeting $125,000 despite warning signs. Ali Martinez notes a concerning divergence: BTC's higher highs contrast with RSI's lower lows, echoing conditions before the 2021 cycle peak. Immediate resistance sits at $113.6K, followed by $115.6K—a breakout could fuel rapid upside.

Meanwhile, Remittix emerges as a dark horse, raising $22 million in its ICO and securing listings on Bitmart and LBank. The project's $0.10 token sale has drawn comparisons to early-stage Bitcoin opportunities, diverting attention from BTC's volatile climb.

Michael Saylor Unveils Bitcoin-Powered Virtual Space Station Amid Market Turbulence

MicroStrategy's Michael Saylor has launched "Station B," a conceptual Bitcoin-powered orbital habitat, as part of his ongoing campaign to promote cryptocurrency adoption. The AI-rendered station features commercial amenities including a Bitcoin ATM and transactional diner, framed as prototypes for off-planet commerce.

Saylor's digital avatar guides viewers through the simulation, declaring Bitcoin the foundation for "humanity's first independent financial ecosystem." The publicity stunt coincides with a 15% August decline in MicroStrategy shares, reflecting investor unease about the company's aggressive Bitcoin accumulation strategy.

Indian Court Sentences 14 in Bitcoin Kidnapping Case

An Indian anti-corruption court has delivered life imprisonment sentences to 14 individuals, including a former BJP MLA and 11 police officers, for their roles in a 2018 kidnapping and Bitcoin extortion scheme. The group targeted Surat businessman Shailesh Bhatt, coercing him into transferring cryptocurrency assets.

The Ahmedabad court found former MLA Nalin Kotadiya and ex-SP Jagdish Patel guilty of leading the conspiracy. Evidence revealed the perpetrators exploited Bhatt's connection to recovered Bitcoin following the BitConnect collapse. "Officers weaponized state authority for personal enrichment," stated special prosecutor Amit Patel during proceedings involving 173 witnesses.

Authorities will transfer seized gold from convicted officers to the Mumbai Mint. The verdict underscores growing intersections between cryptocurrency holdings and traditional criminal enterprises in India's evolving digital asset landscape.

CryptoAppsy Launches Real-Time Market Tracking Tool for Cryptocurrency Traders

CryptoAppsy emerges as a nimble solution for cryptocurrency traders seeking real-time market data without the friction of account creation. The mobile application, available on iOS and Android platforms, delivers instantaneous price updates across thousands of digital assets—from market leaders like Bitcoin to emerging altcoins.

The platform's infrastructure processes global exchange data with sub-second latency, enabling traders to identify arbitrage opportunities and react to volatile price movements. Historical charting functionality provides contextual depth for technical analysis, while customizable watchlists consolidate market information across multiple assets into a single view.

Portfolio tracking features allow manual input of holdings with real-time valuation updates, though the current iteration lacks automated synchronization with exchange accounts. The application distinguishes itself through push notification alerts that trigger based on user-defined price thresholds across tracked assets.

Businesses Accumulate Bitcoin at Quadruple the Mining Rate, River Research Reveals

U.S.-based Bitcoin financial services firm River reports that corporate demand for Bitcoin now outpaces new supply by a factor of four. According to their Sankey-style analysis dated August 25, businesses are absorbing approximately 1,755 BTC daily—nearly four times the 450 BTC produced by miners post-halving.

The research defines 'businesses' expansively, encompassing both dedicated Bitcoin treasuries and traditional corporations holding BTC on balance sheets. River's methodology combines public filings, custodial address tagging, and proprietary heuristics to track these institutional flows.

Miners currently generate about 450 BTC daily following April 2024's halving event, which reduced block rewards to 3.125 BTC. With an average block time of 10 minutes, this creates roughly 144 blocks—and corresponding new Bitcoin—each day.

Notably, the data reveals other substantial institutional inflows. Funds and ETFs collectively account for an additional 1,430 BTC in daily net demand, further straining the limited new supply.

Individuals Maintain Majority of Bitcoin Holdings as Institutions Gain Ground

New research from River, a U.S.-based Bitcoin financial services firm, reveals that individual investors still dominate Bitcoin ownership, controlling approximately 65.9% of circulating supply—equivalent to 13.83 million BTC. The findings, shared via a post on X, categorize holdings using public filings, custodial address tagging, and prior blockchain analysis.

Institutional adoption is accelerating, with businesses accounting for 6.2% (1.30 million BTC) and ETFs/funds holding 7.8% (1.63 million BTC). Governments trail at 1.5%, while lost coins (7.6%) and Satoshi-era holdings (4.6%) complete the distribution. The data underscores Bitcoin's dual identity as both a decentralized asset and an emerging institutional investment.

Gryphon Digital Mining Merges with Trump-Linked American Bitcoin to Form Nasdaq-Listed ABTC

Gryphon Digital Mining shareholders have greenlit a merger with American Bitcoin, a venture backed by the Trump family, creating a new Nasdaq-listed entity under the ticker ABTC. The deal combines Gryphon's mining infrastructure with American Bitcoin's aggressive accumulation strategy, positioning the merged company as a formidable player in the sector.

The transaction includes a 5-for-1 reverse stock split of Gryphon shares, reducing outstanding shares from 82.8 million to 16.6 million—a tactical move to meet Nasdaq's minimum bid price requirements. Market capitalization and shareholder equity remain unchanged, according to the company.

Eric and Donald Trump Jr. are involved in the venture, adding political intrigue to the deal. The merger, first announced in March, now clears the path for a consolidated Bitcoin mining operation leveraging both firms' technical expertise and strategic assets.

Investors Drop Lawsuit Against Strategy Bitcoin Firm as Case Dismissed With Prejudice

Investors have voluntarily withdrawn a class action lawsuit against Strategy Bitcoin, a prominent Bitcoin treasury firm, bringing an end to legal proceedings. The dismissal, granted with prejudice, prevents any future refiling of the case.

The lawsuit, initially filed in May 2025 by New York-based Pomerantz LLP, alleged misleading statements about the profitability of Strategy's Bitcoin investments and inadequate risk disclosures. Lead plaintiffs Michelle Clarity and Mehmet Cihan Unlusoy claimed the firm overestimated returns while downplaying market volatility.

Strategy holds approximately $68.5 billion in Bitcoin following the resolution. The withdrawal of claims signals a decisive conclusion to the dispute, which had been pending in the Eastern District Court of Virginia.

Bitcoin Faces New September Catalyst With ‘American Bitcoin’ Launch

Bitcoin enters September with cautious optimism, trading above $110,000 after months of ETF-driven gains. Market sentiment now pivots to the launch of 'American Bitcoin,' a U.S.-centric version of BTC designed for regulatory compliance and domestic branding.

The project aims to attract investors hesitant about Bitcoin's decentralized nature, though skeptics question its ability to rival BTC's network strength. Analysts debate whether this spinoff will bolster Bitcoin's legitimacy or create market confusion.

How High Will BTC Price Go?

Based on current technical indicators and market developments, BTC has strong potential to reach $125,000 in the coming months. The technical setup shows bullish MACD divergence while trading near Bollinger Band support, suggesting upward momentum. Fundamentally, institutional accumulation at quadruple the mining rate combined with political catalysts and new market listings creates a perfect storm for price appreciation.

| Target Level | Probability | Timeframe | Key Drivers |

|---|---|---|---|

| $115,000 | High | 1-2 months | MACD bullish crossover, institutional demand |

| $125,000 | Medium | 3-4 months | Political catalysts, Nasdaq listing effects |

| $135,000+ | Low | 6+ months | Sustained institutional adoption, macro conditions |